Source: World Bank

Source: World Bank

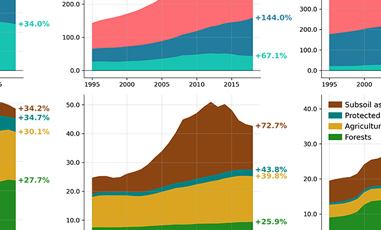

One of the main additions to the new Sovereign ESG Data Portal is the wealth dataset. This annual dataset coveres 146 countries between 1995 and 2018 is the latest iteration of the World Bank's global wealth accounting database. The recent book The Changing Wealth of Nations 2021: Managing Assets for the Future accompanies this dataset and puts focus on policy insights for sustainable development.

Source: World Bank

Source: World Bank

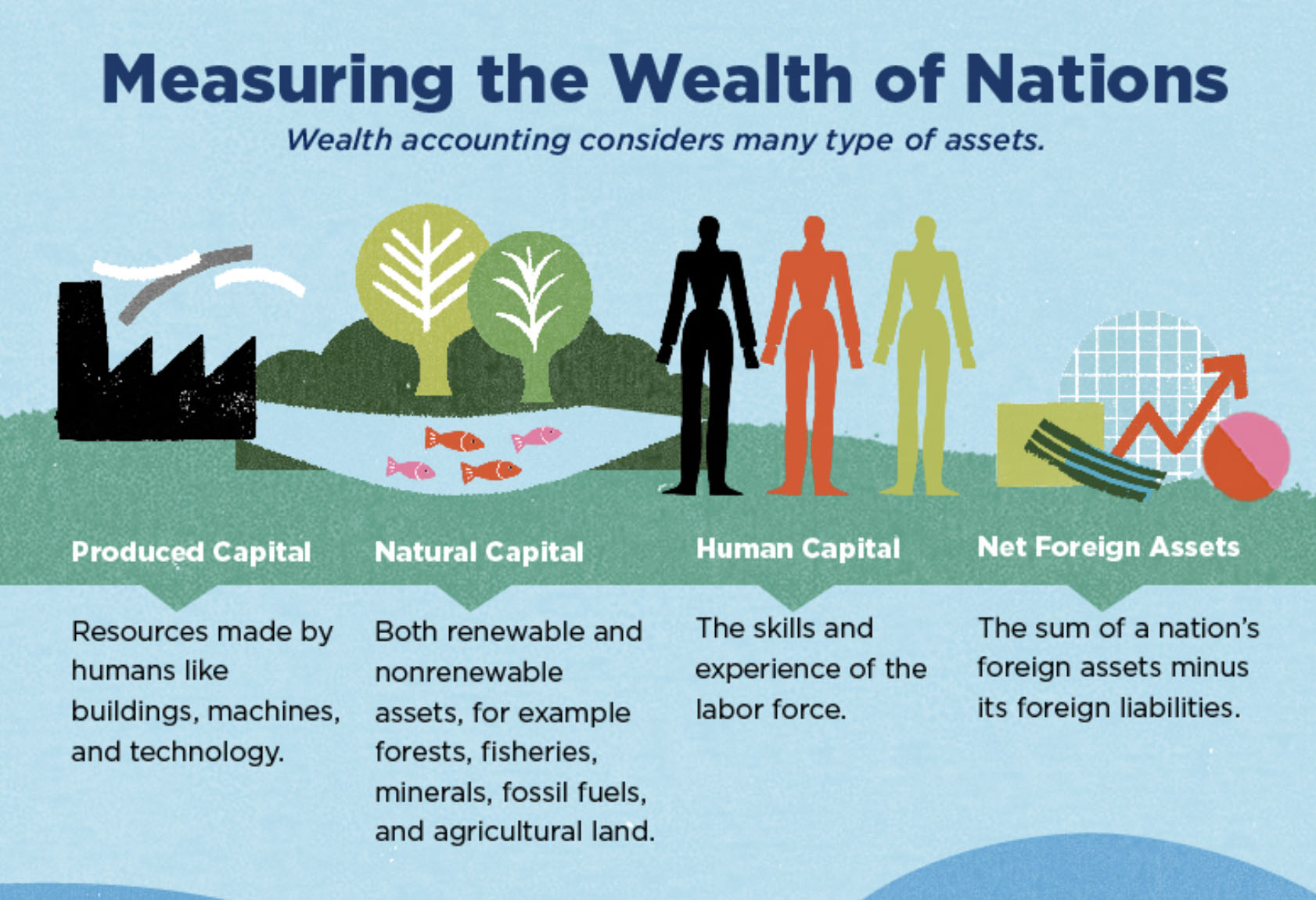

What is wealth accounting?

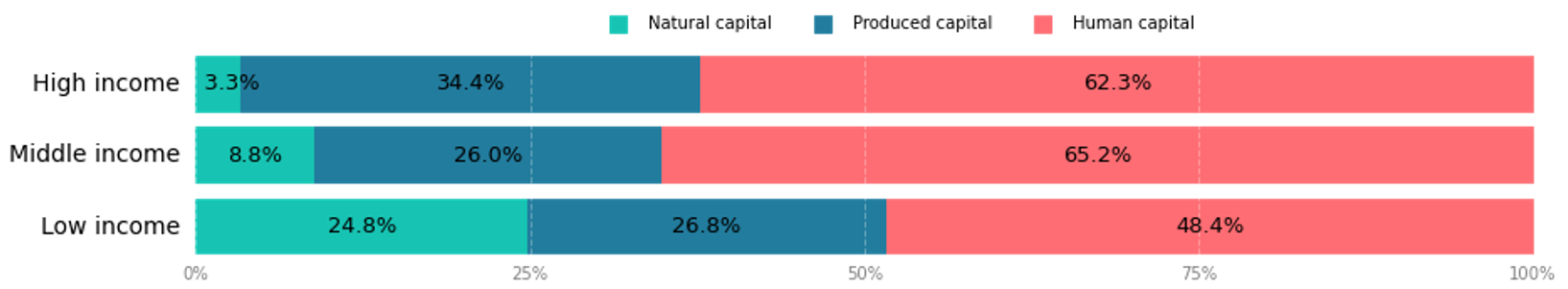

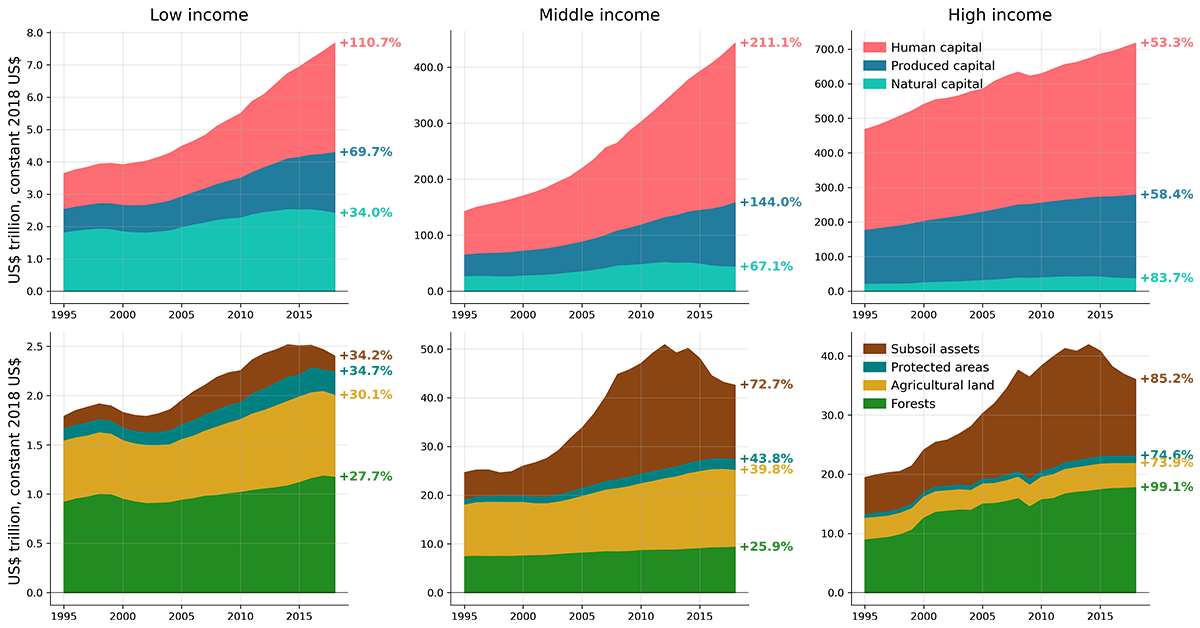

Wealth accounting quantifies the life-time earnings of a country’s assets in monetary terms. The wealth methodology provides a robust, quantitative framework for thinking about sustainability in terms of natural, produced, and human capital. For instance, human capital is calculated as the discounted expected life-time earnings of a population. A similar rationale applies to the valuation of natural resources. A country’s fossil fuel wealth is calculated as the discounted value of future resource rents until this nonrenewable resource is depleted. Renewable resources, such as forests or agricultural land, distinguish themselves in that their discounting horizon depends on the rate of extraction versus replacement. For instance, forest capital is a function of (inflation-adjusted) unit rents, harvest quantities, and the difference between deforestation and reforestation or afforestation rates. In principle, renewable resources can produce rents in perpetuity.

Source: World Bank

Source: World Bank

Environmental materiality does not imply economic materiality

Natural capital data is not the same as "raw" environmental data. That is, agricultural capital is not necessarily the same as how much of a country's land cover and land use is dedicated to agriculture. This can be seen using the quadrant analysis tool by comparing Natural capital per capita, agricultural land with Agricultural land (% of land area). The horizontal axis is the "raw" environmental data while the vertical axis shows the corresponding wealth data. The figure covers 146 countries with data from 1995-2017 in grey and 2018 colored by income group. The low correlations show that the economic valuation of agricultural wealth is largely unrelated to its geographic size. Wealth data, therefore, contain additional information that is not captured in raw environmental data. Because wealth accounts are constructed to measure economic materiality and long-term sustainable growth potential, they can complement sovereign ESG analysis which contains indicators on the "raw" environmental metrics.

Open this view in the portal.Looking forward

The Wealth accounts will continue to be developed by the World Bank with updated time series and by expanding the database with important assets such as renewable energy and the carbon storage value of forests and mangroves. Further, the methodologies are being reviewed to ensure consistent and robust measures and standards. These changes, in turn, can be implemented in the Sovereign ESG Portal and will strengthen the use of wealth accounts and provide stronger indicators of national sustainability going forward.