Featured items

New

Blog post

Navigating bank failures amid sovereign defaults in emerging markets

Sovereign defaults in Emerging Markets and Developing Economies (EMDEs) increased significantly after the Covid-19 pandemic, with 31 defaults in 2020 and 38 in 2021. According to the World Bank Group’s latest International Debt Report, external debt burdens across low- and middle-income countries continue to build, reaching a record US$8.9 trillion in 2024, with interest payments climbing to an all-time high of US$415 billion—straining fiscal space just as more countries confront rising risks of default.

Read more

New

Blog post

How global insurers are helping extend billions in financing to emerging markets

Global insurance companies are proving their potential to be a potent force for scaling up lending to companies in developing countries, despite the challenges they face.From high risks to underdeveloped markets and regulatory constraints, a litany of factors has limited the exposure of insurers in emerging economies. But by partnering with development finance institutions, which specialize in overcoming these obstacles, global insurance companies can get exposure to profitable and impactful transactions.

Read more

Blog post

Corporate tax incentives for green growth: Where, when, and how they are being used

Tax policy is a popular tool for governments around the world seeking to influence behavior, including for encouraging environmentally sustainable investment. But is it really an effective way to accelerate the transition to a greener economy? A Prosperity Insight Note, based on findings from a new World Bank database of Corporate Income Tax (CIT) incentives, reveals that tax incentives are rewarding polluting economic activities in more cases than they are promoting sustainability.

Read more

Blog post

Innovative finance – How securitization tools can mobilize private capital for climate finance

A new capital markets issuer made its debut on the London Stock Exchange this month: The Climate Investment Funds (CIF) Capital Markets Mechanism or CCMM issued its USD500 million inaugural bond on January 22, 2025, which was six-times oversubscribed. CCMM is the first pure play climate issuer and the first multilateral climate fund to access the capital markets. This is the culmination of an 8-year journey from when the Clean Technology Fund or CTF, one of the two funds within CIF and a key multilateral sources of climate finance, explored how to operate in a more financially efficient manner.

Read more

Blog post

Acting on climate through the banking sector

Emerging market and developing economies (EMDEs) face higher risks from climate change than advanced economies. If not addressed, these risks could threaten their stability, negatively impact economic opportunities and development outcomes, and even set back decades of work to end extreme poverty and boost prosperity in these countries.

Read more

Data deep dive

Finance and Prosperity Report 2024

Discover the critical insights of the Finance and Prosperity Report 2024 through these compelling interactive graphs. Engage with these visualizations to explore the data, understand the trends, and gain valuable insights into the future of finance and prosperity.

Read more

Blog post

A Thai Recipe for Green Finance: What’s Cooking in the World of Sustainable Finance?

A Thai Recipe for Green Finance: What’s Cooking in the World of Sustainable Finance?

Read more

Blog post

Emerging market sovereign issuers address demand for transparency and rigor in capital market transactions

Emerging market economies require USD 6.9 trillion to USD 7.6 trillion between 2023 and 2030 in order to achieve the Sustainable Development Goals. Additionally, intergovernmental organizations and research institutes worldwide estimate that global investments up to USD 275 trillion will be required between 2020 and 2050 to reduce greenhouse gas (GHG) emissions to net zero by 2050.

Sovereigns in emerging markets are recognizing the need for additional finance and exploring a myriad of options, including borrowing from the capital markets through dedicated sustainable financing instruments that earmark proceeds for specific types of projects. Since 2016, twenty-six emerging market (EM) sovereigns have issued green, social, and sustainability (GSS) bonds amounting to USD 125 billion, as of 30 June 2024. A key aspect of these labeled bonds is that issuers need to report the use of proceeds and the social and environmental impacts of projects and activities supported.

Read more

Blog post

Driving a virtuous cycle of inclusive green finance

Addressing climate risks and seizing opportunities to finance the transition to a sustainable economy are some of the most urgent and complex tasks currently facing the financial sector. Financial regulators and supervisors play a key role in guiding the financial sector to manage climate risks and mobilize finance for climate action more effectively. However, to ensure a just transition that makes sure vulnerable segments of the economy are not left behind – especially in developing countries – regulators and supervisors must consider financial inclusion when implementing measures to green the financial sector.

Read more

Blog post

Taxonomy astronomy: The global search to define sustainable finance

Arresting climate change will require trillions of investment, the vast majority of which must come from private investors. As issuers increasingly market their offerings to investors seeking green investments, how can they be sure they are putting their money to promote causes as intended?

Read more

Blog post

How Rwanda’s inaugural Sustainability-Linked Bond broke new ground in leveraging private capital

For Rwanda, a country deeply committed to its own Vision 2050, the challenge is not just in meeting these lofty goals, but finding the financing to make it happen. The Development Bank of Rwanda is a key player in Rwanda’s quest for sustainable development. However, there’s a catch. Its traditional funding sources—namely, the Rwandan government and international institutions—are limited and often access is already stretched.

Read more

Blog post

Charting the right course: How sovereign ESG indices can help navigate capital flows

Nearly $500 trillion is invested in financial assets worldwide. While markets are increasingly recognizing the risks of climate change and biodiversity loss, the financing gap to meet the goals of the Paris Accord and Sustainable Development Goals (SDGs) continues to rise. Low- and middle-income countries are especially affected.

Read more

Blog post

How can the financial sector spur progress toward climate goals?

With the Earth experiencing rapid changes undermining critical life-support structures, transitioning to a low-carbon, climate-resilient global economy has become urgent. This is reflected in the Paris Agreement, a legally binding treaty of 196 entities under which they have pledged to lower greenhouse gas emissions contributing to climate change. Financial institutions and capital markets—which fund investments into future economic activities—must become a greater force for addressing climate change and encouraging low-carbon growth.

Read more

Blog post

Ambitious, yet feasible: Setting FAB targets for sustainable financing instruments

Setting a reachable target has been more art than science. Here at the World Bank, we developed the Feasibility-AmBitiousness (FAB) Matrix to give more structure to the target setting exercise. As the name implies, the FAB Matrix gauges targets along feasibility and ambitiousness dimensions. This helps issuers map out possible blind spots and avoid targets that are vulnerable to greenwashing accusations : i.e. highly ambitious targets may not be feasible (long shots), and, likewise, highly feasible targets may not be ambitious (low-hanging fruits).

Read more

Working paper

Could Sustainability-Linked Bonds Incentivize Lower Deforestation in Brazil’s Legal Amazon?

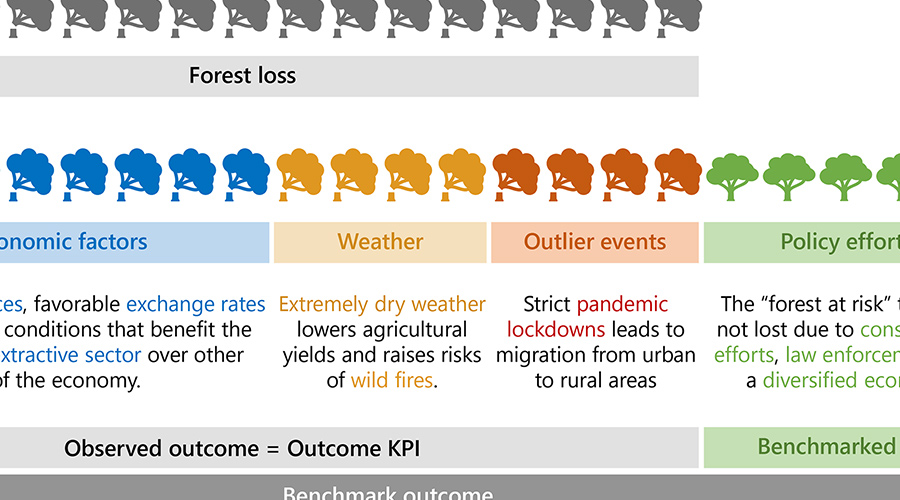

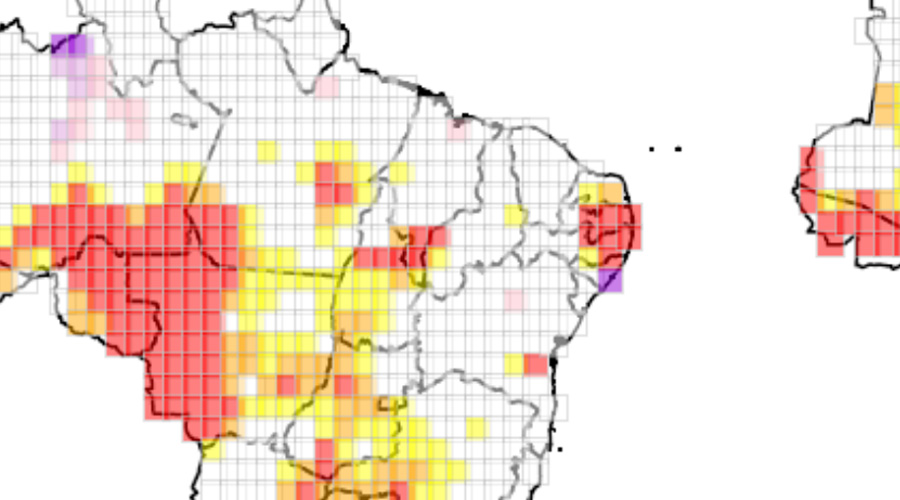

This paper proposes a new relative evaluation and benchmarking framework for performance-linked financing instruments. It argues that the carrots and sticks of sustainability-linked bonds should not use key performance indicators which are solely tied to outcomes. Instead, they should be based on its issuer's level of performance with respect to a target. The paper defines performance as the part of the outcome that the issuer can influence. Otherwise, the issuer may be rewarded or penalized for factors outside their control. In such a case, principal-agent theory would predict a dilution of the performance-based instrument's incentives. This framework is then applied to deforestation in Brazil's Legal Amazon and estimate performance by accounting for the real effective exchange rate, global commodity prices, and prevalent deforestation trends. The results show that policy efforts helped lower deforestation in the 2000s, even after accounting for external factors. The trend reversal and acceleration in deforestation since 2012 are partly due to weaker policy and macroeconomic factors. Based on these results, the paper proposes an Amazon sustainability-linked bond, which could allow for a more effective mechanism to incentivize policy efforts. The paper also introduces the feasibility and ambitiousness matrix to set sustainability performance targets. The matrix is used to define the terms low-hanging fruits and long shots and to discuss why such targets are subject to the risk of greenwashing.

Read more

Report

The Potential Implications of Economic and Social Rights for Sovereign Debt Investing

This paper discusses both the relevance of economic and social rights (ESRs) for environmental, social, and governance (ESG) investing in the sovereign debt asset class and how to start incorporating these rights into the investment process in a practical way. Many in the investment industry recognize the potential role that investors can play in influencing a country’s decisions on environmental and social issues, including human rights. Investors are also increasingly acknowledging the potential to influence a sovereign’s actions on social issues, such as ESRs, given the state’s direct role in providing a pathway to social advancement for its citizens. The rest of this paper is organized as follows. Section 2 explains the relevance of ESRs to the sovereign debt asset class. Section 3 introduces the income adjusted ESR dataset, and section 4 illustrates the insights that this dataset can provide for sovereign debt investors. Section 5 provides one practical example of how sovereign debt investors could use such a dataset in practice. Section 6 presents our conclusions.

Read more

Video clip

Data for Better Investments: Sovereign ESG Data Portal

The continued rise in sustainable investing is only matched by the continued demand for more and better data. The World Bank's Sovereign ESG Data Portal includes 71 Environmental, Social, and Governance (ESG) indicators ranging from water stress, coastal protection, forest cover loss, heating and cooling degree days, precipitation anomalies, and new data on economic and social rights. This video showcases the data portal features and capabilities and how sovereign ESG data can be incorporated into investment decision and financial analysis.

Read more

Blog post

Pitch perfect: Tuning financial instruments for harmony with sustainable development goals

Sustainability-Linked Funds (SLFs) represent an innovative approach to mobilizing private capital towards achieving sustainable development goals. By leveraging concessional finance from donors, SLFs can enhance credit for issuers and offer a financial incentive for achieving pre-established Key Performance Indicators (KPIs). SLFs can invest in conventional debt instruments, avoiding fragmentation of the debt portfolio and supporting emerging market issuers' access to private capital.

Read more

Report

More for Less: Scaling Sustainability-linked Sovereign Debt

‘More for less’ demonstrates how a viable market for sustainability-linked debt can address the triple challenge of public debt distress, climate shocks and nature degradation. The paper charts out building blocks, use cases and seven pathways for scaling sustainability-linked sovereign debt. Barriers to achieving scale are also addressed, from data and technology shortfalls to restrictive accounting practices and coordination failures among key stakeholders. As a way forward, the paper calls for coordinated, ambitious interventions by key stakeholders across the sustainable sovereign financing universe.

Read more

Blog post

Stepping out of the comfort zone: What’s next for sustainability-linked financing?

Chile and Uruguay broke new ground this year by selling bonds whose costs will be linked to meeting climate sustainability goals. On its $2 billion borrowing in March, Chile will have to pay more interest if it misses targets for cutting carbon dioxide emissions and expanding renewable energy. In the case of Uruguay’s $1.5 billion October issue, the rates will rise or fall depending on whether the country meets emissions and forest targets.

Read more

Event

Sustainable Finance Architecture to Scale Investments in Climate Action

This event will discuss how global sustainable finance architecture reforms and development of the innovative financing tools and processes can help unlock climate finance, and what impact they would have on emerging markets, global and national development/climate agenda. The event will showcase how the World Bank Group is working with global partners to build an enabling framework to leverage climate finance for emerging market and developing economies (including International Sustainability Standards Board (ISSB) and Network for Greening Financial Sector (NGFS)), and will provide regional examples related to the implementation of these reforms in the context of the specific initiatives and projects.

Read more

Blog post

Could a sovereign sustainability-linked bond help protect the Amazon? Part 2

In an upcoming publication “An Economic Memorandum for the Brazilian Amazon” we introduce the concept of a model-based KPI. The key idea here is that outcome and performance are not the same. Performance is the difference between an observed outcome and would have been expected, based on a forward-looking statistical model.

Read more

Blog post

Striking the right note: KPI for sovereign SLBs

Governments in many countries are looking for innovative financial instruments to address the triple crisis of unprecedented debt levels, climate change and nature loss. Sovereign bonds – representing almost 40% of the $100 trillion global bond market -- are the largest asset class in many institutional investors’ portfolios. They are one of the key instruments for channeling capital to emerging markets and developing economies (EMDEs). Yet many developing countries are unable to deploy the capital needed to take action to avoid negative impacts of climate shocks and nature loss, particularly following the pandemic crisis.

Read more

Blog post

New pieces for the puzzle? Geospatial insights into droughts and employment in Brazil

Droughts, wildfires or deforestation have easy-to-see effects on our environment and our economy – but what about financial markets? Is environmental degradation, accelerated and intensified by climate change, accurately accounted for in asset prices? Answering this question of financial materiality can be as daunting and confusing as piecing together a puzzle with missing pieces. The wealth of geospatial data provides a new box of promising puzzle pieces.

Read more

Blog post

Could a sovereign sustainability-linked bond help protect the Amazon? Part 1

International investors are increasingly interested in promoting sustainable development. Deforestation in the Brazilian Amazon is among the world’s greatest environmental challenges, despite declines from a 2004 peak in Brazil’s Legal Amazon, which includes nine states covering the Brazilian share of the Amazon and parts of two other biomes. Recently, deforestation appears to be accelerating again. Could more decisive government action have averted this recent increase? If so, can financial instruments help incentivize governments to protect critical natural assets like the Amazon going forward? It’s possible.

Read more

Blog post

What economic models can tell us about slowing deforestation in the Brazilian Amazon

Recent deforestation alerts suggest that forest loss in the Brazilian Amazon is slowing. This is good news – but also not entirely surprising. Economic models are becoming increasingly able to foretell the direction of deforestation.

In April 2023, we published our projections for Brazil’s Land Use Change and Forestry (LUCF) emissions based on a new macroeconomic model. Back then, we only had official deforestation data until 2021. Nevertheless, the model predicted falling LUCF emissions for 2023 which is consistent with the easing deforestation pressures in the “arc of deforestation” we are now witnessing.

Read more